Life Insurance

What is Term Life Insurance?

Term Life Insurance is often considered to be one of the simplest and most affordable life insurance products available. It's a popular choice because it offers:

Affordable fixed Monthly Rates

A Variety of Term Lengths

Guaranteed Death Benefits

Peace of Mind for You and Your Family

Request an Affordable Term Life Insurance Quote from Wash Park Family Insurance.

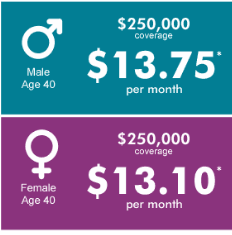

* Example assumes a 40 year old male buying a 10 year term life insurance policy. Example assumes a 40 year old female buying a 10 year term life insurance policy.

Requesting a free, no-obligation term life insurance quote through our firm is now faster and easier than ever! You can get a personalized, free, and no-obligation term life insurance quote in just a few minutes. It's that easy to start helping protect your family's financial future!

Why Wash Park Family Insurance?

With over 17 years of experience, WPFI has access to multiple product lines from multiple leading insurance companies to ensure that you get the best coverage at the most competitive rates. When your insurance applications are submitted they are assigned a relationship manager and underwriting consultant so we can get your coverage in place as soon as possible.

We have built strong relationships with many of the industry’s top carriers, including:

Why do I Need Life Insurance?

A life insurance policy can protect & provide for your loved ones when you no longer can with:

College Tuition

Mortgage payments

Outstanding Debt

Monthly Income

Washington Park Family Insurance offers several types of life Insurance.

We have found most clients are best served with low cost term insurance, however; we also help clients navigate the insurance world and other Life Insurance types. We are happy to help you find the right type of insurance to give you and your family peace of mind.:

Term Life

Consider choosing term if you only need coverage for a set period of time (like covering a mortgage or until your children are grown). Because it covers only a set time (like 10 or 20 years), term is the less expensive option.

Whole Life

Whole Life Insurance can provide coverage for your entire life. Consider choosing whole if you want coverage that pays for your final expenses or helps you leave a legacy no matter when you pass away. Whole life is more expensive but covers you for the rest of your life.

Universal Life

Consider choosing universal if you are looking for permanent insurance that also fits into a complex financial plan. Universal Life can provide both flexibility and financial advantage. This policy can accumulate cash value and has flexible payments.*

* Changes to Universal Life Insurance premiums may cause the policy to become underfunded and potentially lapse. Make sure you consult with an insurance professional prior to making changes in your policy's premiums.